What Is A Small Business Federal Government Contractor?

- Ken Larson

- Nov 1, 2023

- 4 min read

“SMALLTOFEDS” – By Ken Larson

“Explaining the term, “Contractor” and the regulatory factors and practical considerations related to use of the term from a small business federal government contracting perspective.”

________________________________________________________________________________

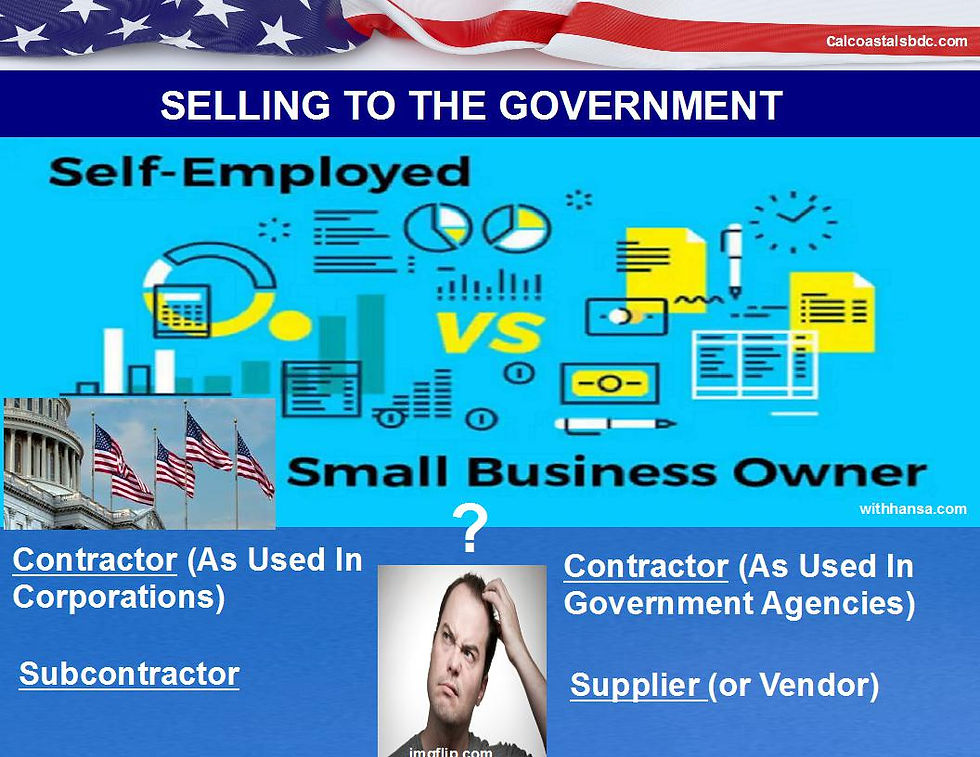

“There is often confusion regarding the definition of the term, “Contractor” in government work. The term is used in a conflicting manner to describe companies, individuals and business relationships. It has different connotations within corporations as opposed to government agencies, and is often confused with terms like “Subcontractor”, “Supplier” or “Vendor”.

DEFINITIONS

1. Contractor (As Used In Corporations) The term “Contractor” in corporations often refers to an individual, performing work for a company while not on the payroll as an employee, having no taxes, benefits or deductions taken from their pay and not covered by any form of insurance. The company issues a purchase order to the individual at an hourly rate and submits a Form 1099 to the US government reporting what the contractor is paid for services. The contractor must self-insure during the contract period and pay taxes on the money earned at the end of the tax year.

The use of individuals as contractors in large government contracting corporations has been limited due to class action law suits brought by contracting individuals who maintained they were utilized as employees without the associated benefits. As a result, in many companies the existing contractor work force was either offered permanent positions or released. Since that time, the use of contractors by large government prime contractors has been principally in specialty roles.

Corporations may also utilize the term “Contractors” when referring to companies in the manner defined by Definition 2, below. It is common for large prime contractors to use the term to describe themselves, their competition or co-equal teaming partners in joint ventures. When this 2nd definition is used it refers to a company, duly registered with the state and the federal government.

2. Contractor (As Used In Government Agencies) The term “Contractors” in government parlance refers to businesses, not individuals. To become a contractor to a government agency, you must therefore form your own business. Government agencies do not engage individual “Contractors” as defined in 1, above. If they want individuals to perform services they put them on the agency payroll. If they want to acquire specialized outside services they contract with companies.

3. Subcontractor

A “Subcontractor” is a company that takes on a flow-down of liability from a prime contractor to complete a major portion of a large scale job for the prime contractor’s customer. The subcontractor is obligated to the prime contractually in an identical fashion as the prime is obligated to the government agency. The prime contractor issues a subcontract with a statement of work and flow down terms and conditions from the prime contract to the subcontractor. In many instances the government requires review and approval of major subcontractor selections and holds the prime contractor accountable contractually at the prime contract level for the subcontractor(s) efforts.

4. Supplier (or Vendor) The term, “Supplier” connotes basically commercial relationships with companies that supply off the shelf parts and materials or simple, generic services. The General Services Administration (GSA) and other federal agencies also use the term to describe companies in negotiating supply schedules or in buying items under the commercial sections in the Federal Acquisition Regulation (FAR), such as FAR Part 12. Supplier contracts generally emphasize, price, delivery and matters such as warranty and do not involve -complex terms and conditions or the flow down of liability from the ordering firm prime contract.

REGULATORY FACTORS

The Federal Acquisition Regulation (FAR) clauses governing small business state that a company undertaking a small business set-aside prime contract must be capable of performing 51% of the work scope under the terms of that contract and may not subcontract (as in 3, above) any more than 49% of the effort. These FAR clauses do not limit 1099 contractors (as in 1, above).

Many small enterprises use independent contractors on call to fulfill the manpower requirements of their contracts and specify these personnel in their proposals as qualified individuals. When these clients grow in long term contracts they make such personnel permanent party if the contractors are willing. Often contingent hire agreements are used for that purpose while proposing major programs. You can download a generic agreement from the “References” Box Net cube in the right margin of this site.

Contractors (as in 1, above) may be used to the extent they are necessary to win, but bear in mind the government prefers to see permanent party, since that implies stability (the government is conditioned to the perception that individuals , as contractors come and go).

Small business should propose work scope under set aside programs in teaming agreements so that the prime (small business) is performing at least 60% of the effort with employees or contractors to avoid the appearance of a front by a larger company (even though the statutory requirement is 51%).

In many cases it is preferable for a start-up small business to become a subcontractor, rather than a prime, building past performance associated with government contracting and developing beneficial teaming relationships with experienced government contracting firms.

SUMMARY It is possible for a small business to perform, in tandem, one or more of the “Contractor” roles discussed in this article. Sometimes multiple roles are established with the same corporation or agency. Please use the search box at this site to view articles for information related to this topic.

It is vital to understand the “Contractor” role definition for each contractual commitment to insure suitable risk analysis, a good past performance record, conflict of interest avoidance and a solid reputation in the industry.”

Comments